franklin county ohio tax lien sales

The auctions are often called Sheriffs Sales. These are liens for unpaid income payroll or business taxes.

From the Franklin County Treasurers Office.

. These buyers bid for an interest rate on the taxes owed and the right to collect. As of October 17 Franklin County OH shows 34 tax liens. When a Franklin County OH tax lien is issued for unpaid past due balances Franklin County OH creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties.

Delinquent and Pro-Rated Taxes. After receiving the Delinquent Land Tax Duplicate from the Franklin County Auditor the. Unsure Of The Value Of Your Property.

Successful bidders at the Warren County Ohio tax deed sale receive an Ohio tax deed. Interested in a tax lien in Franklin County OH. Franklin County Ohio Tax Lien Sale Registration Friday October 5 2012 Posted by.

Franklin County Treasurer 373 S. The Delinquent Tax Division holds an annual tax lien sale to collect outstanding delinquent taxes. Interested in a tax lien in Franklin County OH.

Ad Find County Online Property Liens Info From 2021. The following is a list of the services and duties of the Delinquent Tax Division at the Franklin County Treasurers Office. High St 21st Floor Columbus OH 43215 6145254663.

Find All The Assessment Information You Need Here. As of October 14 Franklin County OH shows 0 tax liens. When a Franklin County OH tax lien is issued for unpaid past due balances Franklin County OH creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties.

If you havent received a notice of satisfaction from the party with the lien usually the Ohio Attorney Generals office then you should contact them first to get more information about obtaining the satisfaction. Search for Allen County Sheriffs real estate sales listings by address case number defendant name or sale date or browse all property listings. Administering Tax Lien Sales.

How does a tax lien sale work. In Ohio the County Tax Collector will sell Tax Deeds to winning bidders at the Franklin County Tax Deeds sale. Generally the minimum bid at an Franklin County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property.

According to state law any Ohio county can hold a property tax lien sale. Ohio Tax Liens. Unpaid property taxes are beyond the scope of this guide.

High St 1st Fl. 123 Main Parcel ID Ex. High St 17th Floor Columbus OH 43215 6142218124.

Interested in a tax lien in Franklin County OH. Tax Payer Information If you have received a letter in the mail about the annual tax lien sale or you fear your property may be eligible for the lien sale you have options. In an effort to recover lost tax revenue tax delinquent property located in Franklin Ohio is sold at the Warren County tax sale.

Franklin lot 73 010e049 08900 111 chicago av 010-005641-00 baer laurie 721 garden st 310 jackson st. John Smith Street Address Ex. Laura Ratcliff Share Franklin County Ohio 2012 Tax-Lien Certificate Sale Registration.

After a lien is sold if all lien charges and interest are not fully paid after one year the tax lien holder has the right to foreclose on the property. All bidders may submit a request for parcel exclusions once registered. Understanding your Tax Bill.

Redeemed means the property owner pays you for the. 301 North Main St Suite 203 Lima OH 45801. Search All of the Most Up-to-Date Foreclosure Listings Available Near You.

The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. Franklin County Clerk of Courts 345 S. As of now 34 counties have lien sales but more are considering it.

Ad Register for Instant Access to Our Database of Nationwide Foreclosure Listings. The AGs Office has a hotline for such inquiries. How does a tax lien sale work.

The Franklin County Treasurers Office will be closed on. If you require further assistance please contact one of the following Franklin County government offices. Tax lien purchasers and other interested parties with tax related issues.

The property is sold to the successful bidder state laws differ though often it is sold for the amount of unpaid taxes. The State of Ohio can obtain a judgment lien against a taxpayer when a tax has been assessed but has not been paid. Our office is open Monday.

Our office is. Net tax due fee due net lien value 010-000708-00 keens too llc 907 e fifth ave 864 e 4th ave bidleman lot 48. Search for a Property Search by.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Franklin County OH at tax lien auctions or online distressed asset sales. Ohio wholesale auto sales llc 3154 sandridge ave450 acres 010m038 16300 0 e hudson st 010-062590-00. The other counties hold deed auctions.

According to state law the sale of Ohio Tax Deeds are. Franklin County Auditor 373 S. How does a tax lien sale work.

When a Franklin County OH tax lien is issued for unpaid past due balances Franklin County OH creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties. As of October 29 Franklin County OH shows 12 tax liens. Please keep in mind that you must register in order to bid.

Please read the following information or call our office at 614 525-3438 for help. Tax bill process is a long and involved process which starts with you. This guide addresses the problem of Ohio tax liens also called judgment liens.

On average 95 percent of tax liens are redeemed by the owner. The County assumes no responsibility for errors. Franklin County OH currently has 3738 tax liens available as of July 6.

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

Farmland Auction Prime Land Auction 234 5 Acres Offered In 6 Tracts In Franklin County Indiana Schrader Real Estate And Auction Co Land Auction Marketing Experts Nationwide

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

Franklin County Treasurer Land Bank Program

The Essential List Of Tax Lien Certificate States

The Essential List Of Tax Lien Certificate States

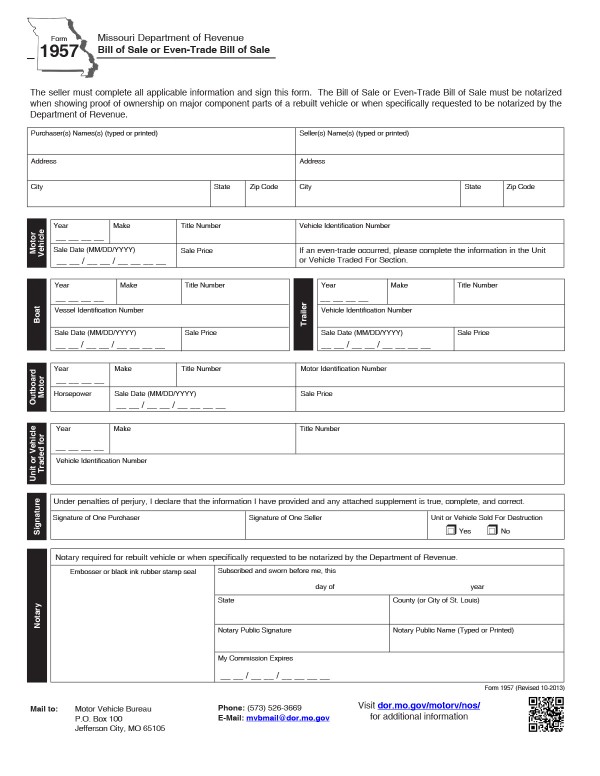

Missouri Bill Of Sale Form Templates For Autos Boats And More

Franklin County Oh For Sale By Owner Fsbo 69 Homes Zillow

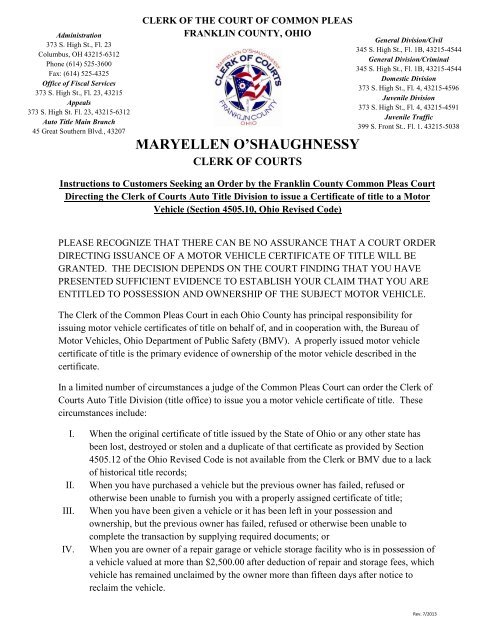

New Court Order Instructions Franklin County Ohio

The Essential List Of Tax Lien Certificate States

Franklin County Oh For Sale By Owner Fsbo 69 Homes Zillow

The Essential List Of Tax Lien Certificate States

Farmland Auction Prime Land Auction 234 5 Acres Offered In 6 Tracts In Franklin County Indiana Schrader Real Estate And Auction Co Land Auction Marketing Experts Nationwide